Lately I’ve been interested in getting back into the stock market. I say “getting back into” because for a little while (aka the late 90s early 00s) I, like many people, bought into make-some-extra-pocket-change.com and then got out when the bottom fell out. So, why come back? And why now?

Well, as you may have heard I’m unemployed. I’m beginning to remedy that and it’s starting out as a part-time venture so anything I can do to supplement my income is on the table. Before I get to that, let’s look at a quick case study. I realized that I had (potentially) made quite a bit of cash on really the only stock I kept after the whole fun-run. I was a newly minted Apple fanboy in 2000 and I actually bought the stock then.

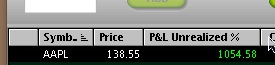

If you can see the image you’ll notice the AAPL stock unrealized percentage shows that the stock went up 1054.58%. This was a definite buy & hold situation. In fact, it was a buy and forgot-about-it situation. I thought I had closed out all my positions at E-Trade, but I guess I held onto this for the last 8 years. I forget how many I’d actually bought and at what price because I know it’s split at least once before then, but a little math shows my adjusted cost basis of $12/share. And today it’s above $134. Monster, huh? Well really monster would have been selling it at its peak of $180… As it is now, I could sell it all and get a nice new iphone and laptop each for me, my wife, and my cats.

Up to now I’ve always been a savings guy. My Mom and Dad both worked at banks and I really only ever used the savings accounts, CDs, and other FDIC insured stuff to keep money safe, and I figured I was making enough money and had enough that I’d save every month that I was happy with that level of growth for socking away money for later. Now, though, the income level is certainly lower, and with interest rates so low, there’s got to be a way to make some more rainy-day-money, and correctly applying myself to the stock market looks like a better way to go.

I don’t have a businessy background, but being Asian-American I am stereotypically very good at Math, and there’s lots of math to be good at. I’ve already dabbled a little and bought and sold a few things so here’s what I’ve learned so far.

I need to develop a strategy for choosing stocks to watch. I have been accumulating sources for this, and one that came up recently is StockTwits which uses that social network of the moment Twitter as a platform for people to discuss trading. Like most sources of information there is an awful lot of noise; I’m still deciding if there’s enough signal for this to be worth it, but at the very least it does show when there’s a lot of buzz about a stock and buzz tends to mean movement…. now if that movement is in the direction you want is a different story.

I need to develop a strategy for calculating risk vs. reward. this means I shouldn’t be blindly guessing. I should treat the trades as experiments for this strategy. This means I need to set up a hypothesis; i.e. where the price should move. I should also be ready if my hypothesis is wrong. In short, I need to be a little more advanced than just buying and watching, I need to set exit points. This both limits my exposure and locks in my gains. This step alone will differentiate me from the dabbler I was years ago, so I want to write it down here in another article later.

I need to limit my trading fees. E-Trade’s per trade commission fee for the normal investor is $13/trade. If I buy a stock, then sell some to book some gains then sell the rest when it falls, that’s 3 transactions. That means $39, and that adds up. If I do >10 trades a month the fee drops to $10/trade, but just as an example, in the light dabbling I’d done in e-trade, I have made about $1000 in realized money (i.e. I sold the stock vs. unrealized like AAPL where I’m just holding it) and to make all that money I’ve accumulated about $500 in trading fees. OUCH. Now, still $500 net isn’t bad, but there’s got to be a better way. There are a couple of brokerage houses that don’t have as high fees (ScotTrade is supposedly as low as $7/trade) but then I heard about Interactive Brokers which charges only exchange fees — 1/2 cents per share with a $1 minimum. I.e. if I buy 500 shares that’s $2.50 in fees. If I buy 200 shares, that’s $1. If I buy 1 share just to play with it, that’s $1. The catch is you need to have funded your account with $10,000 or more and have made over 100 trades. I’m not sure how they check the latter (in fact, it looks like they don’t…) but if they’ll have me, that’s a much (MUCH) better deal.

I need to remove emotion from my trading. This is not gambling. I once heard Quint Tatro of Tickerville say when another referred to trading as gambling, “If you want to gamble, go to Vegas and enjoy a free cocktail while you’re at it.” Successful trading needs to be emotionless and logical. Now it shouldn’t be in a vacuum with respect to others’ emotions, but quite often the trade should be made to take advantage of the emotional character of the stock and not to reflect the trader’s. Also, I don’t have enough money to gamble — most plays that are based on a few points move are what’s known as volume plays – you take advantage that the stock may only move a couple points by buying thousands of shares of it, and I have to be more methodical.

I need to keep a journal. Keeping a log of what I did and why will help, and I think is probably necessary to improve on processes and leaning, and I’m going to use this website to keep track. I would definitely not follow me on any trades for a while, but I think I’m going to attempt to keep learning, and it may be interesting to watch how it turns out.

Oh, as for the AAPL? I will probably transfer it towards funding my Interactive Brokers account. Maybe I’ll carve off a piece for that new iPhone.

Warning: Trying to access array offset on value of type null in /usr/home/web/wordpress/wp-content/themes/autofocus/inc/autofocus-template-tags.php on line 307

Warning: Trying to access array offset on value of type null in /usr/home/web/wordpress/wp-content/themes/autofocus/inc/autofocus-template-tags.php on line 310

Warning: Trying to access array offset on value of type null in /usr/home/web/wordpress/wp-content/themes/autofocus/inc/autofocus-template-tags.php on line 313